Wills & Estate planning

Understanding Wills & Estate planning

Estate planning is more than simply drafting a will and powers of attorney. Caring for dependents, the tax consequences of your gifts and bequests, division of assets among family and charities, and decisions regarding financial management and healthcare are important considerations. At The Top Law Firm, we have years of experience in assisting our clients create an Estate plan, which is reflected in a well drafted will and other testamentary documents, to ensure that your family and loved ones are taken care of, your last wishes are properly expressed, and for general peace of mind in your later years. Clear directions and statements of intent can help to avoid disputes among your loved ones in the event of death or incapacity.

Our Will and Estate lawyers also assist executors, or estate trustees, navigate the probate process effortlessly, including when obtaining a Certificate of Appointment of Estate Trustee with or without a Will and administration of estates.

It’s true that estate planning is hardly a cheerful topic. However, it’s a necessary step to help your loved ones get through this stage without unnecessary hassles. To avoid having the law determine your heirs and the distribution of your estate, you will need to make a will.

What is a Will?

A Will, or also known as a Last Will and Testament, is a legal document which designates how to manage your affairs and distribute your assets after death. This includes the distribution of property, guardianship of children (if any), funeral arrangements and more.

What is a Power of Attorney for Personal Care?

A Power of Attorney for Personal Care is a legal document in which one person gives an individual(s) the authority to make personal care decisions on their behalf if they become mentally incapable.

What is a Continuing Power of Attorney for Property?

A Continuing Power of Attorney for Property is a legal document in which one person gives an individual(s) the authority to make decisions about their finances if they become mentally incapable.

Why you need a lawyer to help you with a private lending mortgage

A private lending mortgage requires a lot of paperwork. Some of that paperwork can be difficult to understand. A lawyer helps you negotiate your contracts. Your The Top Law Firm lawyer will complete the mortgage documents, ensure commitments and terms are covered, make sure there are no red flags on your borrower, and keep you informed about what you are signing.

The Top Law Firm provides simple, clear, and honest legal advice. We believe in taking the time to explain what you are signing and why. You get to speak to a dedicated private lending lawyer and ask questions during the process.

Secure

A secure system that keeps your information safe.

Convenient

Easy to access online video calls from the comfort of your own home.

Simple

Easy to sign documents that can be viewed on any device.

What our customers are saying

As a practicing tax lawyer, my expectations from a lawyer providing services to me are very high. I retained Abraham Top to handle a real estate transaction for me and was delighted with the results. Both he and his assistant Jessica dealt with my file on a timely and professional basis. I will refer clients who require a real estate lawyer to him in the future.

David Rotfleisch

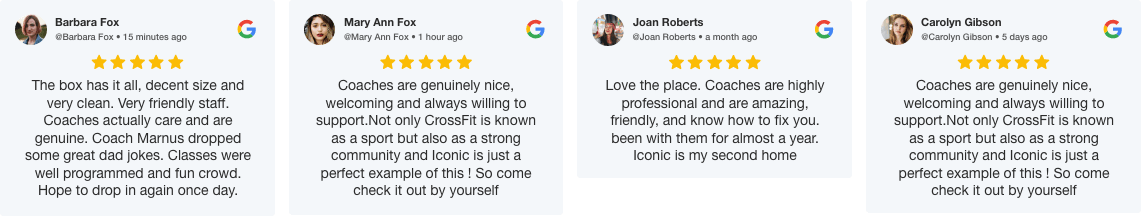

What Our Customers Are Saying

Abraham and Jessica did an incredible job helping us with our real estate purchase. Jessica's quick responses and sharp eye for detail make the process incredibly smooth. I would strongly recommend the Top Law Firm team for all your real estate and legal needs.

David Zelsman

Real estate law FAQs

Why choose The Top Law Firm

We break down the legal jargon and make sure you understand the important details behind your home's mortgage or your lending investment. Our team is efficient, reliable, professional, and cares about you. Don’t take our word for it read some of our great Google reviews.

Daniel

- Abraham Top and Darya Chudzinava were exceptional in assisting me with my mortgage refinance. They were professional and responded to my phone calls and emails timely. My mortgage was being transferred from one lender to a new one, and the new lender - one of the big 5 banks - provided the mortgage refinance documents late, established new criteria for closing that were not originally in the commitment letter, and pushed back my closing deadline by a few days...

Young

- Mr. Abraham Top is truly phenomenal. I can vouch for his excellence in Criminal Law and his impeccable performance in & out of the courts. He is the type of lawyer that will make you feel properly assured throughout the entire trial process. I first met Mr. Top in the year 2009, and he has expanded his firm since. Despite the inevitable growth in his services, he still squeezes out time out of his day to answer my questions as needed. Constantly reliable and professional.

Isabell

- Abraham & Yelena helped me tremendously with an unconventional real-estate sale that my family had to deal with. Someone was always available to discuss any questions or concerns that came up during the sale. Compassion, a wealth of knowledge and great attention to detail was provided during our transaction. I wouldn't trust any other Firm the way I do Abraham and his team, they are absolutely wonderful. I couldn't recommend them more!

Sara

- Abraham Top dealt with my case professionally and diligently. He was thorough and explained each step of the process in detail. He listened to my concerns from start to finish with exceptional patience and ultimately got me what I wanted in the end. I am so grateful for Mr. Top and his staff. His assistant Jessica was always pleasant and very knowledgeable as well. I highly recommend their services.